nflation is an economic term that describes an increase in the cost of everyday goods and services – everything from the groceries we buy at the supermarket to the haircuts we get at the salon. As inflation rises, the value of our money diminishes, reducing the number of items we can afford with the same amount of money as our previous shopping trip. We end up getting less bang for our buck.

Inflation doesn’t only impact consumers—it also significantly affects retailers. When inflation outpaces earnings, consumers inevitably end up buying less, which results in a decrease in the overall value of retail spending. During periods of high inflation, it’s not uncommon to observe an unusual situation where retail spending in nominal dollar terms rises, yet the real value of that spending—what it can actually buy—declines. Hence, assessing the state of the retail industry during times of inflation requires more than just tracking whether the nominal dollar value of sales is increasing or decreasing. We also have to consider the erosion of our money’s purchasing power due to inflation. By adjusting retail sales figures for inflation, we can gain a more accurate and comprehensive understanding of the true state of the retail industry.

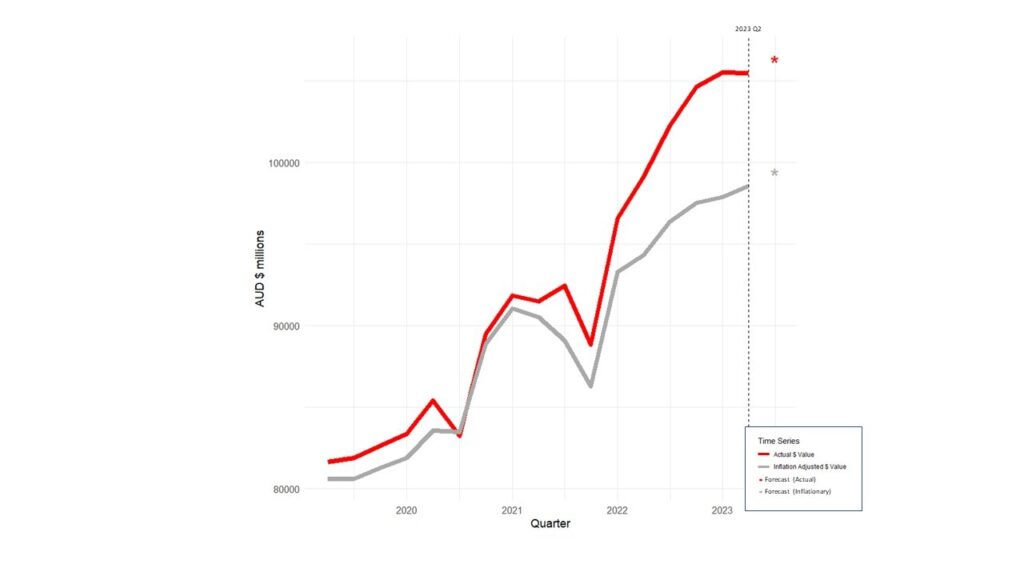

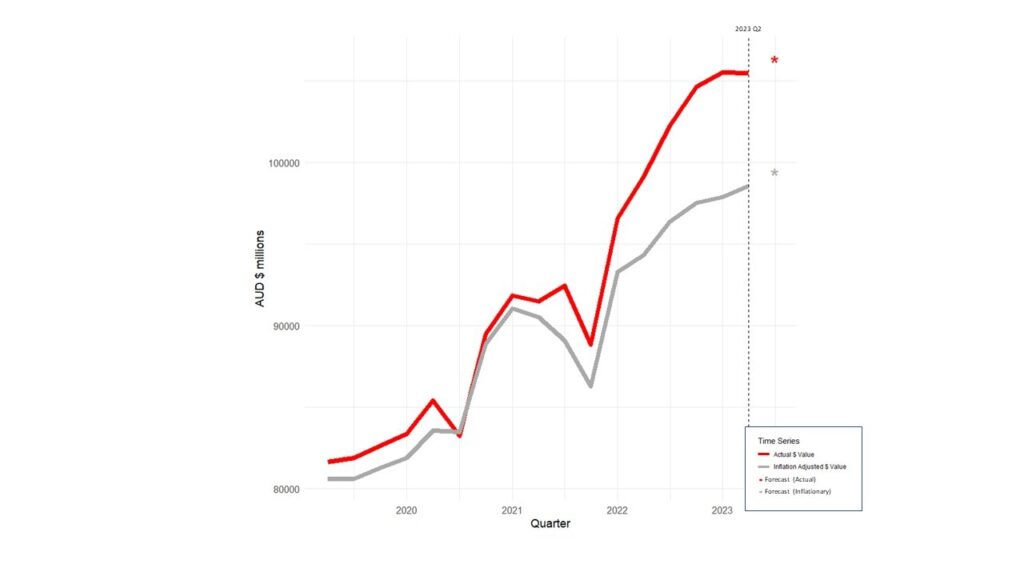

Australian Retail Expenditure – Nominal and Inflation Adjusted (Q1 2019 to Q2 2023)

The diagram above captures the nominal or actual dollar value Australian’s retail sales (illustrated in red) from the beginning of 2019 until now. The diagram also displays the ‘real’ value, or inflation adjusted value (illustrated in grey). Asterisks on the timeline represent Forecast Global’s predictions for retail sales in the second quarter of 2023 both for nominal and real values. This graphical representation powerfully highlights the effect inflation has had on our retail spending. Until the start of 2021, the impact of inflation was relatively minor. However, beginning from Q1 2021, we see inflation noticeably gnawing at the value of retail expenditure.

While this data offers a stark illustration of how inflation has chipped away at our retail spending, it does not fully capture the pressure inflation places on Australian retail businesses. Although the actual value of retail trade has risen, it’s important to consider what percentage of this growth can be attributed to inflation, and what is due to market conditions. Therefore, it’s necessary to separate the wheat from the chaff—to differentiate between the effects of inflation and actual market growth. Only then can we truly comprehend the situation Australian retailers are facing.

To accomplish this, we can compare the nominal retail expenditure from 12 months ago with today’s inflation-adjusted expenditure. If today’s inflation-adjusted expenditure exceeds the nominal expenditure from a year ago, we can confidently assert that increases in retail spending are as much a result of market forces as they are due to inflation. This would be a positive outcome for retailers. On the other hand, if today’s inflation-adjusted expenditure is lower than the nominal expenditure from 12 months ago, it suggests that inflation is eating into the value of spending, negatively impacting the retail industry’s bottom line.

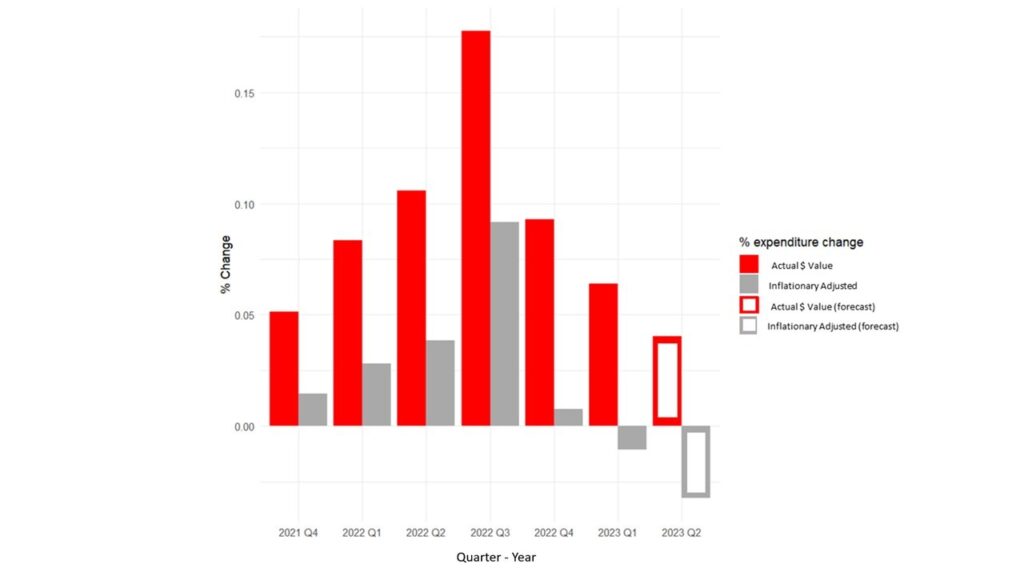

Year-On-Year Erosion of Value in Australian Retail Expenditure

The diagram above performs a year-on-year analysis of changes in the value of both nominal and inflationary adjusted expenditure. This analysis clearly illustrates that between Q1 2021 and Q4 2022 the value of inflation-adjusted expenditure was still rising, suggesting that consumer spending was keeping pace with inflation. However, starting from Q1 of this year, we began to observe the first signs of a decline in inflation-adjusted expenditure, indicating that inflation was starting to outstrip consumer expenditure. Our Q2 Australian retail forecasts predict that this decrease in the real value of Australian consumer expenditure is set to continue. This trend does not bode well for Australian retailers.

The marked decline in the inflation-adjusted value of retail expenditure is largely due to the aggressive policies implemented by the Reserve Bank of Australia (RBA) in their effort to curb inflation. Over the course of the past 12 months, the RBA has hiked interest rates 11 times. Consequently, the cash rate has leaped from 0.1% in May 2022 to 3.85% in May 2023. The escalating interest rates heighten the cost of borrowing, thereby inflating the cost of mortgages and loans. This surge in borrowing costs contracts disposable income, leading consumers to allot less of their earnings to retail spending. Furthermore, rising interest rates can substantially affect consumer confidence, inciting people to adopt more conservative spending habits.

In conclusion, inflation and aggressive interest rate policies by the Reserve Bank of Australia present significant challenges for Australian retailers. As inflation escalates, it erodes the real value of money and reduces consumer retail spending. Although the nominal value of retail sales has increased, much of this growth is attributable to inflation rather than true market conditions. The recent downward trend in inflation-adjusted spending, coupled with a forecast for continued decline, paints a concerning picture for the profitability of the Australian retail sector.