Retail Sales Predictions – By Retail Industry

As Christmas approaches, we thought we would showcase some interesting insights based on our teams data analytic expertise.

RETAILERS ARE IN FOR A SOLID SEASON

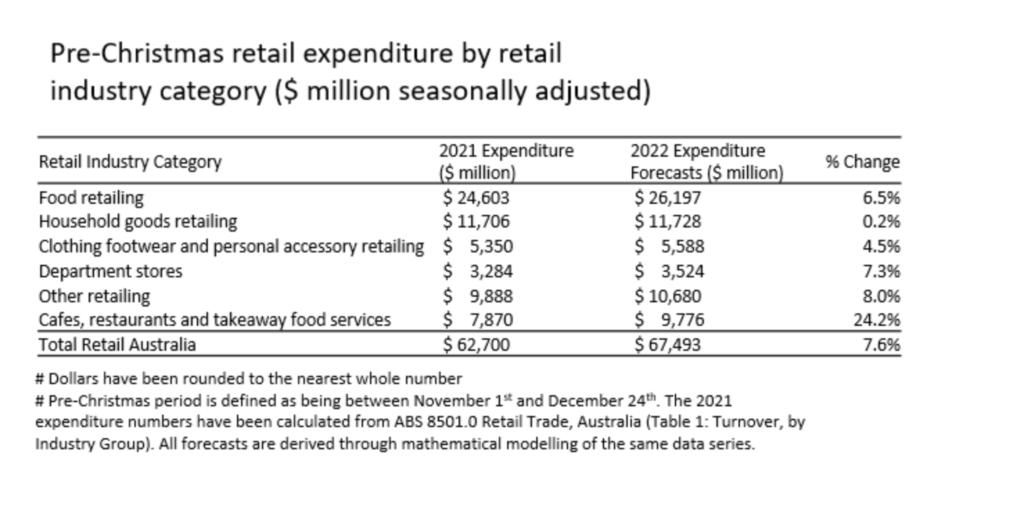

With the notable exception of household goods retailing, all retail industries are set to experience increases in consumer spend, broadly in line with inflation increases. Department store retailing spend is predicted to be at around $3.5 billion (up 7%), food retailing will be around $26 billion (up 6.5%) and other retailing is expected to be around $10.6 billion (up 8%).

NO MORE LOCK DOWNS = LOTS OF EATING OUT!

By far the largest increase will be felt amongst the cafes, restaurants and take away services. Total spend in this category is expected to be around $9.8 billion (up a whopping 24% over the previous year). This large increase can be accounted for in part by inflationary pressures, and in part by the impact of residual COVID restrictions in December 2021.

Predictions for 2023

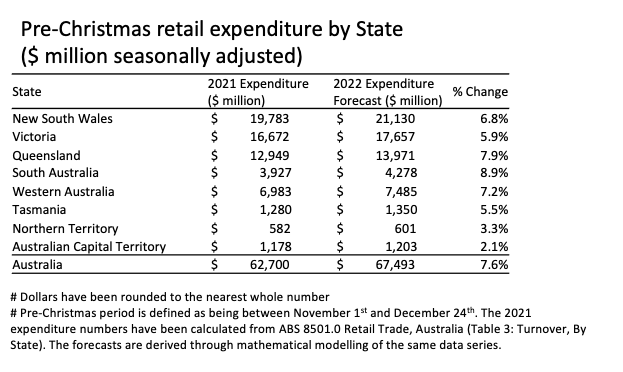

Australia is expected to see a significant increase in retail expenditure over this pre-Christmas period (1st November to the 25th December 2022 with our analytics indicating a bumper Christmas spend compared to Christmas 2021.

But, what does it mean for business in 2023?

With consumers expected to fork out around $67 billion up from $62 billion over the same period last year (an increase of around 7%) it is fair to say that the numbers look good. But a significant proportion of this yearly increase can be accounted for by inflationary effects – a phenomena that can be particularly seen in our predictions for retail spend in South Australia and Queensland.

Our specific modelling identifies retail spend in South Australia will rise from last year’s $3.9 billion to $4.3 billion this year (an increase of 9%) while Queensland spend is expected to rise from last year’s $12.9 billion to around $15.4 billion this year (an increase 8%), but these predictions inevitably align to the September quarter CPI measures across the nation’s capital cities, wherein Adelaide (8.4%) and Brisbane (7.4%) ranked first and second in terms of overall price rises.

The upshot is, whilst, the numbers look strong and show considerable growth, in real terms the economy as a whole isn’t likely to see any real upswing early in the new year and consumer confidence may take a dive with increasing cost of living pressure and rising interest rates.

We are predicting a slow start to 2023 and possible pain all the way through to 2024.

Want to know how you can forecast, plan for and make informed decisions to prepare for 2023?