Introduction

The International Accounting Standards Board (IASB) has published new accounting standards which replace previous accounting that is considered to be no longer fit for purpose. These changes are known as IFRS 16 and came into effect on 1 January 2019.

The objective of this discussion paper is to:

- Provide a context for the IFRS 16 changes and describe its far-reaching impact.

- Describe the accounting treatment of IFRS 16 accompanied with a worked example.

- Introduce some of the financial modelling complexities around IFRS 16 arising from COVID-19.

- Analyse the commercial implications of the changes on various financial metrics.

Background

Nearly every company across all industries use leases as part of their standard operating business model and will therefore be affected by the introduction of IFRS 16 if they are complying with IFRS Standards. The impact on some of the largest companies can be counted in the tens of billions, but even the smaller of organisations that comply with IFRS Standards will need to ensure their compliance with the new rules.

The following table ranks Australia’s largest 20 companies by operating lease obligations.

The new standard applies to annual reporting periods beginning on or after 1 January 2019, meaning all reporting entities need to be prepared for reporting throughout the 2020 financial year.

Under the previous set of rules, lessees could account for lease transactions as either operating or as finance leases, depending on complex rules and tests. The result of which was that either all or nothing was recognised on the balance sheet, even where the leases were, from an economical point of view, substantially similar transactions.

The impact of IFRS 16 is far-reaching and affects both the profit-and-loss statements and balance sheets of entities, but not the cashflow statement. Under the new standard, the distinction between finance leases and operating leases has been eliminated with companies needing to recognise all lease liabilities (exceeding 12 months) as well as accounting for a right-of-use asset.

Accounting Treatment

Before exploring the details of the new standards, there are two key exemptions to consider. Reporting entities are not required to recognise leases under IFRS 16 where the duration is less than 12 months nor where the assets have a value (when new) of less than USD$5,000. However, where there is an option to extend the lease beyond 12 months and the organisation is reasonably certain that it will exercise this option; or the lease contains a purchase option, the lease should be recognised under IFRS 16.

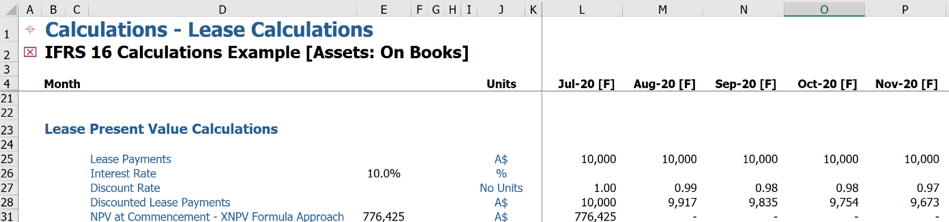

Under IFRS 16, at the commencement of the lease, the lessee should recognise a right-of-use asset and lease liability that is equal to the discounted sum of the payments required under the lease.

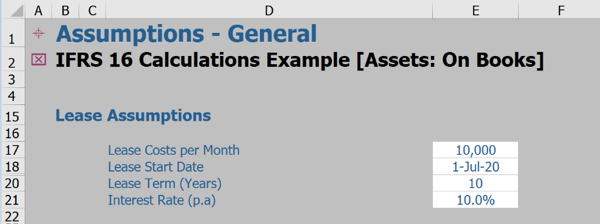

In order to determine what the quantum of the right-of-use asset and lease liability is, the following assumptions are needed. The first three assumptions below are fairly easy to delineate, however the last assumption, the implied interest rate, will require some additional thought.

The interest rate used should be the interest rate implicit in the lease, if that rate can be readily determined, or the lessee’s incremental borrowing rate. The interest rate implicit in the lease is the rate of interest that causes the present value of lease payments and the residual value to equal the fair value of the underlying asset. It is, therefore, independent of the lessee’s borrowing costs. However, if this cannot be easily calculated, the lessee can fall back on their own borrowing rate.

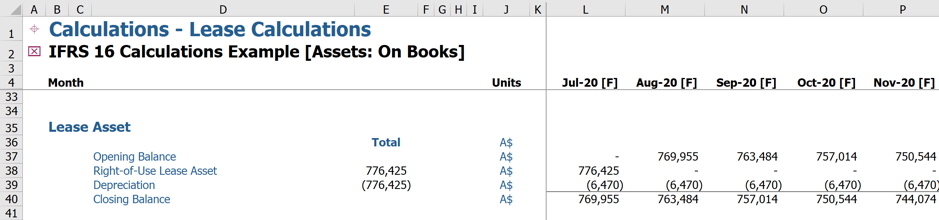

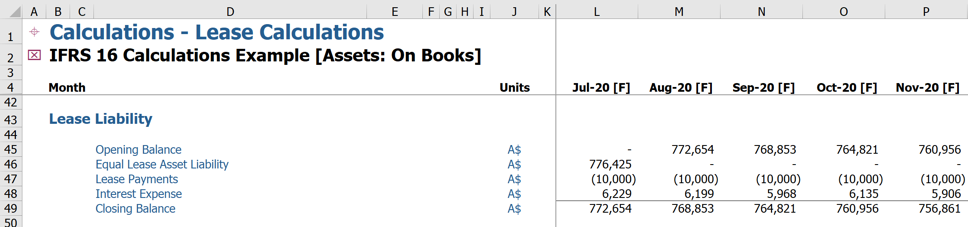

The NPV of the lease payments based on the assumptions above is 776,425 which is initial value of both the right-of-use asset and lease liability. The right-of-use asset is then depreciated on a straight-line basis over the life of the lease. The cash asset is also reduced by 10,000 on a monthly basis as each lease payment is made.

At the end of the lease, the lease asset has a balance of zero and the cash balance is (1,200,000), reflecting 120 monthly lease payments of 10,000 over the ten-year lease term.

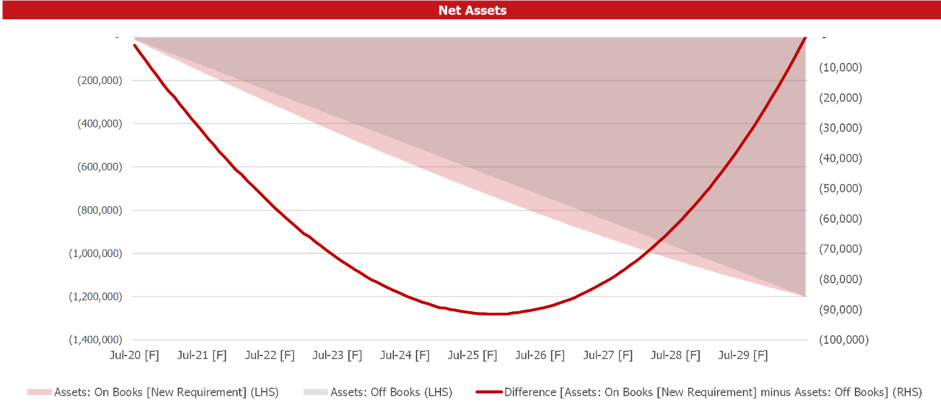

The net impact on the asset side of the balance sheet under the new standard is to post an increase in asset value initially before it is depreciated on a straight-line basis to zero over the life of the lease.

On the liability side, the NPV is again used as the initial value. The liability is reduced by the value of the lease payment. Finally, interest is applied on the remaining balance at the same rate used as part of the discounting. At the end of the lease, the lease liability also has a balance of zero.

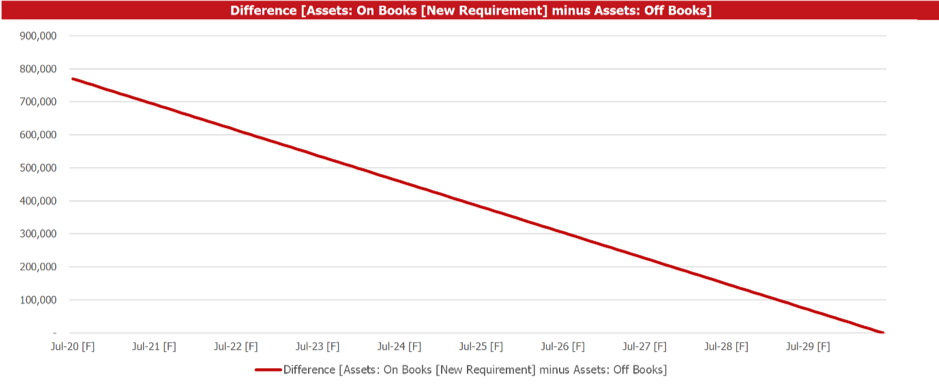

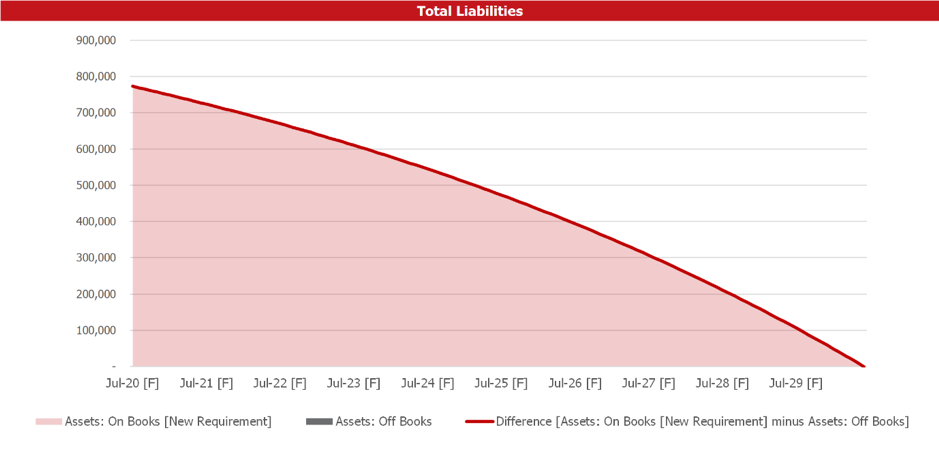

Under the new standard, an initial balance is now recorded as a liability on the balance sheet and reduced over the life of the lease to zero.

On a Net Asset basis, the impact of the new standard is an increasing decline in Net Assets over the first part of the lease before decreasing back to zero over the second part of the lease. The inflexion point will move depending on the interest rate used, but the general shape will remain the same.

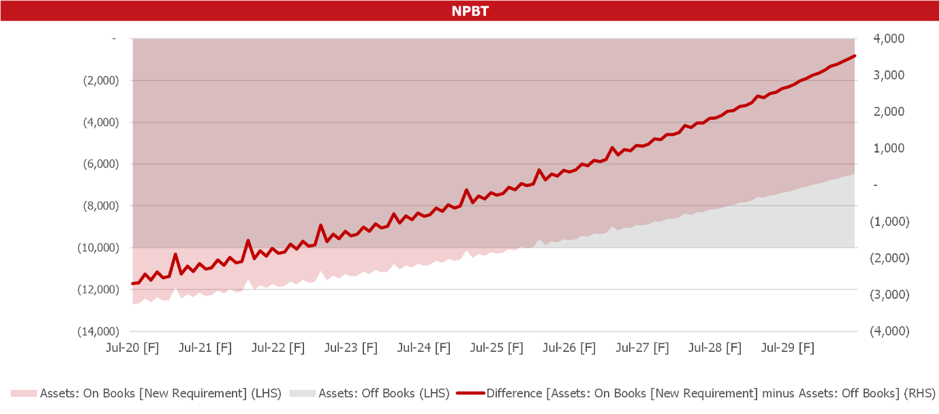

On the income statement, the lease interest expense (from the lease liability) and the depreciation (from the lease asset) are recorded as expenses. The depreciation expense sits between the EBITDA and EBIT lines, whilst the lease interest expenses are recorded between EBIT and Net Profit before Tax.

The net impact of these changes on the income statement over the period of the lease is nil. However, it will increase expenses in the first part of the lease, whilst reducing expenses in the latter parts of the lease.

IFRS 16 and COVID-19

The COVID-19 pandemic has resulted in many companies renegotiating the terms of leases in the form of lease payment reductions or lease payment ‘holidays’. In terms of the financial accounting, this requires lessees to reconsider their treatment of leases and take action if these changes are material.

If changes due to COVID-19 were within the original terms and conditions of the lease contract, either directly or indirectly (for example, from actions imposed by the government), IFRS 16 sets out specific requirements specifying how to account for some changes in lease payments. Otherwise, the required accounting treatment depends on whether that change meets the definition of a lease modification.

If the changes are considered to be a lease modification, there is a series of questions around the nature of the changes which will determine the appropriate action to take given the circumstances.

This can mean arduous work for lessees and the IASB has responded by adding a practical expedient which provides relief. The amendment exempts lessees having to consider individual lease contracts, which have been directly impacted by COVID-19, as lease modifications, and allows companies to account for those rent concessions as if they are not lease modifications. This is designed to reduce the effort of companies in their responsibility to comply with the new regulations.

For more details on this, see IFRS 16 and COVID-19.

Commercial Implications

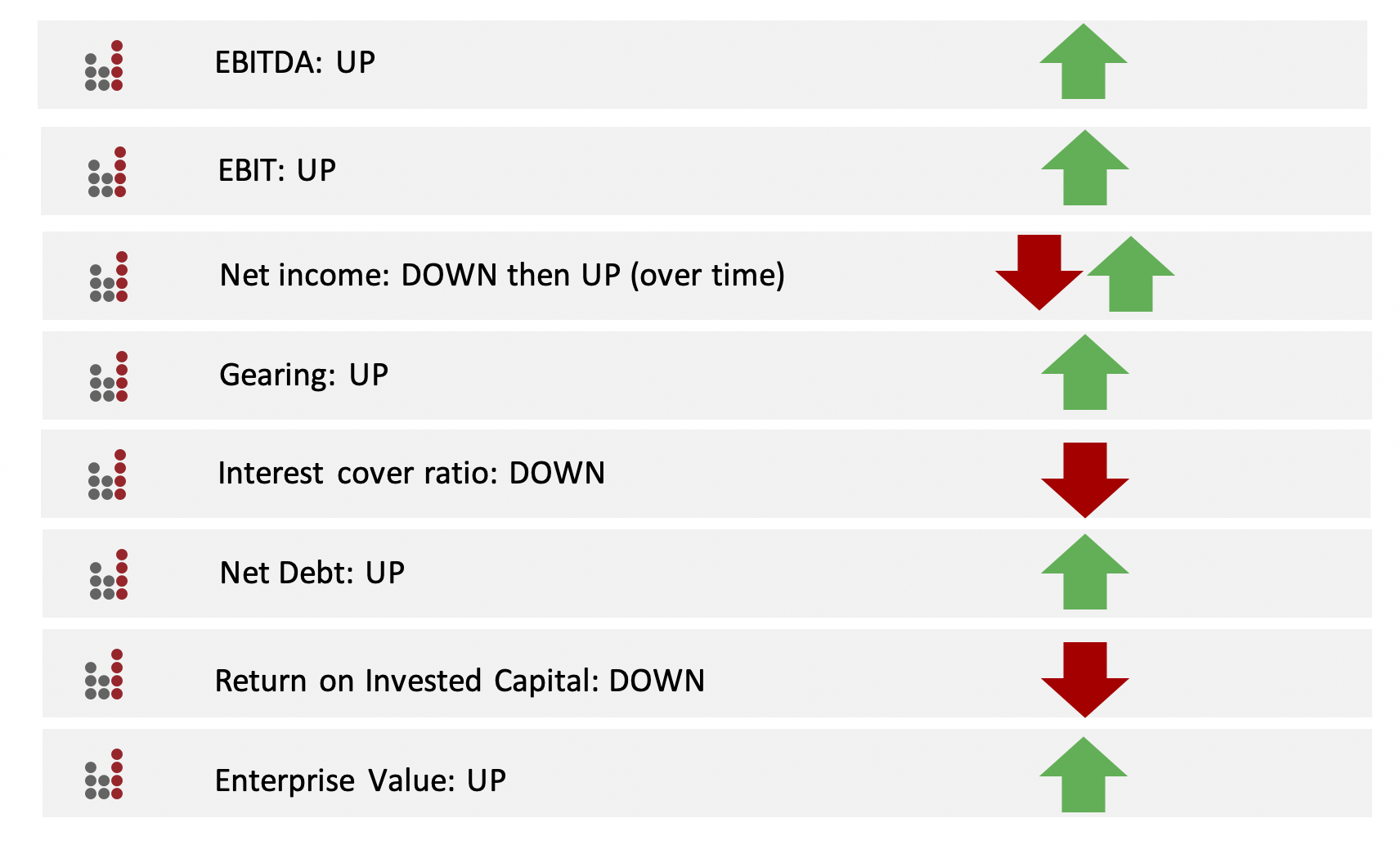

As a result of IFRS 16 changes, virtually all commonly used financial ratios and performance metrics will be affected. Widely referenced metrics listed below will be impacted accordingly:

Thus, loan covenants, credit ratings, borrowing costs and employee contracts will all need to be updated to reflect the new reality.

The impact of these changes may compel many organisations to reassess their ‘lease versus buy’ decision approach and undermine the rationale behind ‘sale-and-leaseback’ decisions. The previous benefits that stemmed from using operating leases as a mechanism to access off balance sheet financing are no longer available and organisations may benefit from purchasing assets that they will need for long periods of time.

Over time, the changes to IFRS 16 should make it easier to compare the financials of different companies in the same industry. However, in the short term, companies should be aware of what numbers they are using for comparison purposes.

At Forecast, we have helped our clients to model the impact of IFRS 16 on their company. Please get in touch with you existing Forecast contact or contact us here if you would like to discuss how we can help with your IFRS 16 or other financial modelling requirements.