In recent years, “stress testing” has become synonymous with the banking sector following the introduction of requirements for banks to simulate a range of adverse hypothetical scenarios such as market shocks and severe recessions to understand resilience. Although this is a requirement for financial institutions, forecasting or “modelling” the impact of a range of scenarios on financial performance is an important practice for all businesses.

Often the primary question of the analysis is “Does the business have enough cash or funding headroom to weather the current situation and remain solvent?”

In a note to financial institutions, Bank of England (“BoE”) summarised stress testing as:

“Analysing how an object or system copes under pressure. Doctors perform cardiac stress tests by getting patients to run on treadmills and monitoring their pulse and blood pressure. Engineers stress test construction materials by measuring their behaviour when subjected to strain.

Bank stress testing is designed to test the resilience of banks to severe but plausible shocks. In practice, this typically means modelling the impact of hypothetical adverse macroeconomic and financial market scenarios on bank profitability and balance sheets.”

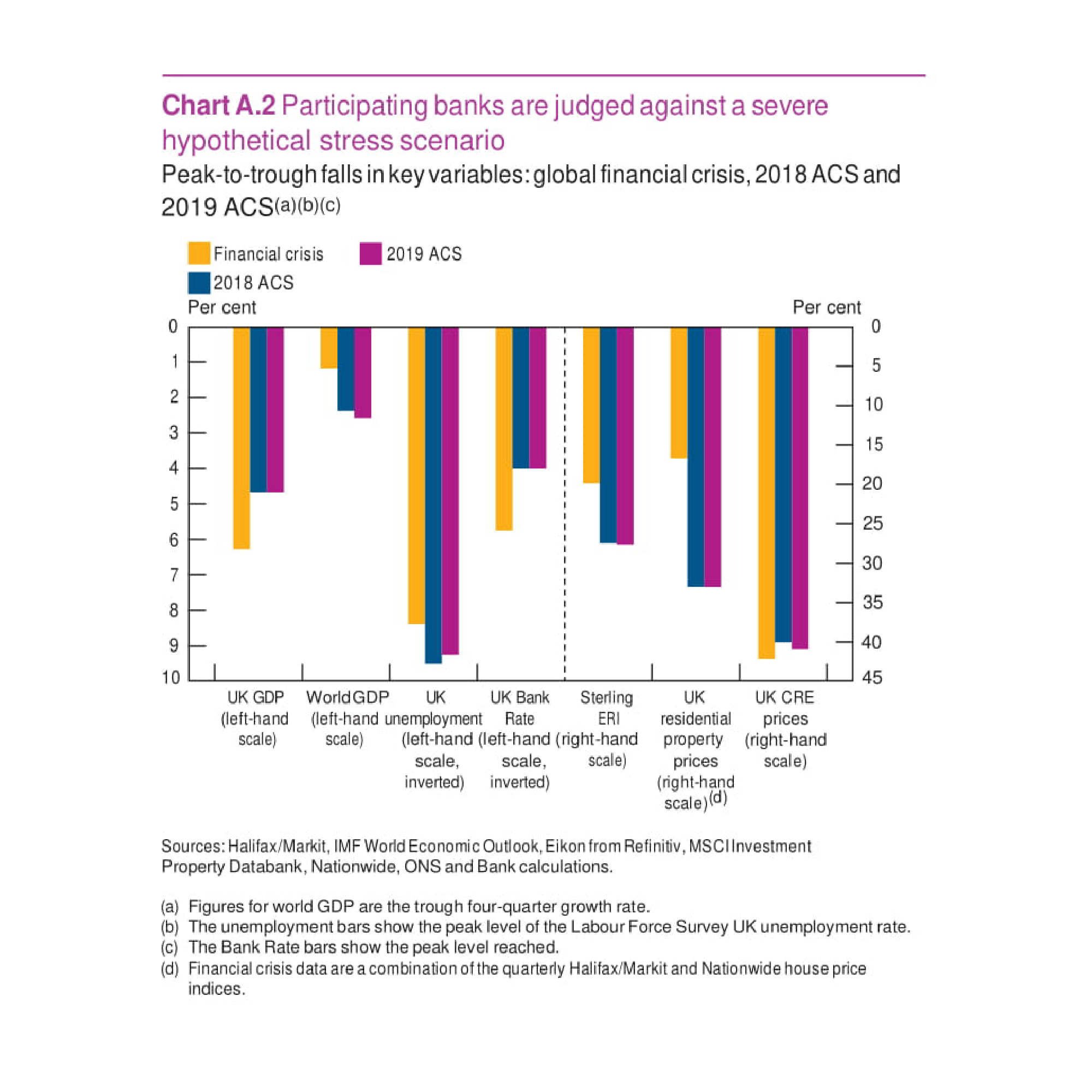

This chart shows the extremes of key macroeconomic assumptions in the BoE’s 2019 stress testing scenario.

Source: Financial Stability Report December 2019, Bank of England

The Key Components of the Stress Testing Process:

Financial Model

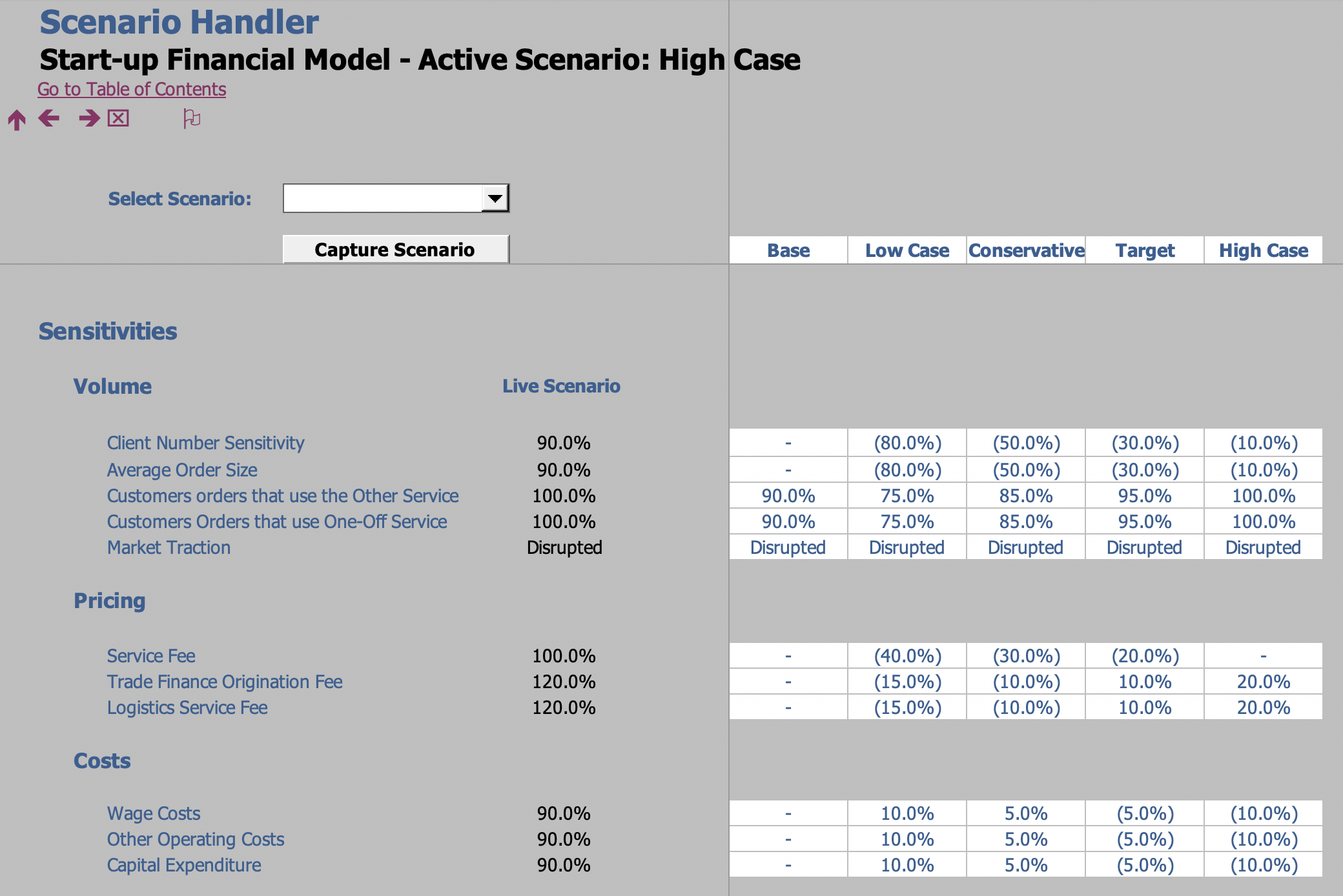

A financial model designed and built by expert financial modellers alongside business stakeholders can allow businesses to run a range of scenarios in seconds. Forecast’s financial modelling clients range from start-ups and SMEs through to leading global financial institutions and we have extensive experience in scenario modelling. We design and build models with a scenario tool as a key component. The scenario tool allows the users to quickly run a range of scenarios and store the outputs within the model itself for variance analysis. A model dashboard such as the one below allows the user to see the impact of the scenarios on key financial metrics, alongside summary outputs of the Income Statement, Balance Sheet and Cash Flow Statement.

To see the report in more detail click on the “full-screen arrow” on the bottom right.

Scenario Modelling as BAU Process

Scenario modelling should be implemented as part of the BAU process, but from our experience working with many different businesses, this is often an exercise that is overlooked. In many cases, scenarios are run by creating multiple versions of the same model, requiring a significant time commitment for each iteration. A well-built, best practice financial model will allow for quick and easy scenario modelling within a single file. The scenarios would reflect how positive/negative changes to the business’ key drivers would affect key financial metrics.

Stress Testing

Stress testing elevates scenario modelling from a BAU process to a tool that can be used to respond to an acute change in the external environment. It is often seen only as modelling scenarios that would negatively impact a business’s outlook and in the current climate, many businesses may find themselves in this category.

However, many financial modelling scenarios may be examining positive changes to the business.

Take a business that has designed and manufactures a new product that experiences higher than expected demand on launching to the market. This is most certainly a positive scenario. However, to meet the demand, the business may require substantial working capital to purchase materials, hire new staff and add new production equipment and facilities.

Any scenario modelling may include modelling the impact of the following:

- Rapidly changing volumes, prices and costs;

- Employee and resource availability;

- Supply chain disruption;

- Exchange rate volatility;

- Loss of key customers or key customers finding themselves in financial difficulty

- Reduced credit terms from suppliers; and

- Restricted access to funding

Stress Testing as Long Term Addition to Your Toolkit

Going Concern

Accounting standards require management of a business to make an assessment as to whether the entity is a going concern for 12 months from the accounting date. Auditors are required to obtain appropriate audit evidence about the appropriateness of management’s use of the going concern assumption in the preparation of the financial statements.

After a string of corporate failures, standards were revised to require auditors to more robustly challenge management’s assessment of going concern, thoroughly test the adequacy of the supporting evidence, evaluate the risk of management bias, and make greater use of the viability statement.

The revised standard will place increased scrutiny on businesses to justify their assessment that the entity is a going concern. Having a robust, transparent and flexible financial model which can run scenarios in seconds will be particularly useful in supporting management’s position and it is expected that auditors will increasing look for their clients to provide evidence by way of sensitivities run through a robust financial model.

Due Diligence

The modelling of financial scenarios is also associated with due diligence processes undertaken by investors, debt providers or acquirers before they invest in or lend to businesses to stress test the target’s business plan. In this context, scenarios are often referred to as “sensitivities”. These sensitivities might consider a range of impacts on an aggressive management growth forecast, and by way of example could include a range of:

- Percentage reductions in sales;

- Percentage increases in materials costs or general inflation;

- Time delays to product development processes;

- Adverse changes to debtor and creditor receipt/payment profiles;

- Percentage increases to capex requirements.

Case Study

Our client required a dynamic model that switched between BAU and its regulator’s Capital Adequacy Assessment (Bank of England’s Internal Capital Adequacy Assessment Process) mode. The tool was built with the functionality to switch between these modes using only a single check box, effectively working as two separate models within one file, as well as the ability to analyse the variance in outputs. The model was structured in such a way that all assumptions were easy to update, meaning any adjustments could be processed very quickly, saving the finance team significant time in responding to board level and regulatory requests. This single tool drives the finance team’s budgeting and forecasting process, as well as their regulatory reporting.

An example of a Forecast financial model Scenario Handler is provided below.

In the current climate, as all businesses are placed under pressure due to external shocks, stress testing is a key tool that can be used to analyse the resilience of your business and inform the decisions you need to take.

Please get in touch with your Forecast contact or at info@forecast.global if you have any questions about Stress Testing.